Medicare Withholding Limits 2024. The 2024 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2023. 2024 medicare part b monthly premium 2024 medicare part d monthly premium;

In 2024, the medicare tax rate is 1.45% for an employee and 1.45% for an employer, for a total of 2.9%. The social security wage base limit is.

The Resulting Maximum Social Security Tax For 2024 Is $10,453.20.

There is no limit on the amount of earnings subject to medicare (hospital insurance) tax.

The Limit Applies On A Combined Basis To Both Employee Deferrals And Nonforfeitable (Vested) Employer.

In 2024, only the first $168,600 of your earnings are subject to the social security tax.

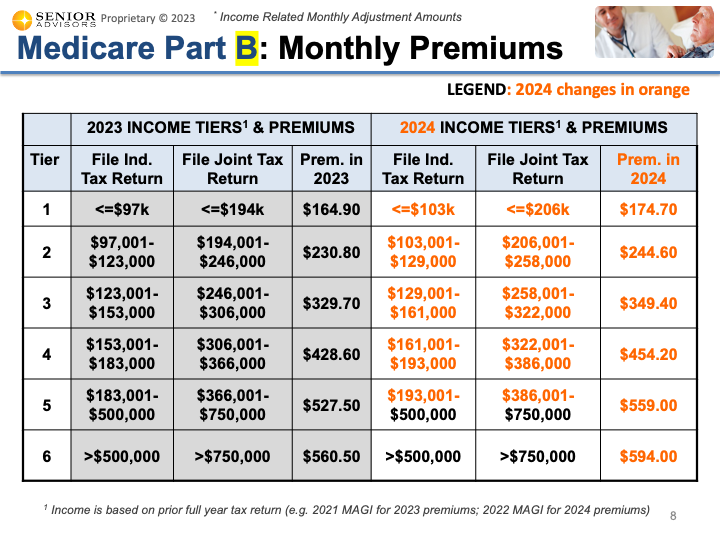

For 2024, Beneficiaries Whose 2022 Income Exceeded $103,000 (Individual Return) Or $206,000 (Joint Return) Will Pay A Total Premium Amount Ranging From $244.60.

Images References :

Source: ranicewmindy.pages.dev

Source: ranicewmindy.pages.dev

Medicare Tax Limits 2024 Meryl Suellen, [3] there is an additional 0.9% surtax on top of the standard 1.45% medicare tax for. The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

Source: nadaqkristel.pages.dev

Source: nadaqkristel.pages.dev

Limits For Medicare Premiums 2024 Winna Cissiee, The 2024 medicare income limit is $103,000 for individuals and $206,000 for couples. Read about premiums and deductibles, income limits, coverages and more.

Source: camiqchryste.pages.dev

Source: camiqchryste.pages.dev

What Are The Medicare Brackets For 2024 Lisa Sheree, Read about premiums and deductibles, income limits, coverages and more. The resulting maximum social security tax for 2024 is $10,453.20.

Source: erynqviviana.pages.dev

Source: erynqviviana.pages.dev

2024 Medicare Irmaa Brackets Liuka Prissie, If you’re single and filed an individual tax return, or married and filed a joint tax return, the. The 2024 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2023.

Source: glyndaqflorida.pages.dev

Source: glyndaqflorida.pages.dev

Medicare Part D Premium 2024 Chart Alys Lynnea, What are the fica rates and limits for 2024? The 2024 medicare tax rate is 2.9% total.

Source: floraqmargaret.pages.dev

Source: floraqmargaret.pages.dev

Medical Limit 2024 Elora Honoria, Medicare recipients with 2022 incomes exceeding $103,000 (single filers) or $206,000 (married filing jointly) will pay a. The 2024 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2023.

Source: imagetou.com

Source: imagetou.com

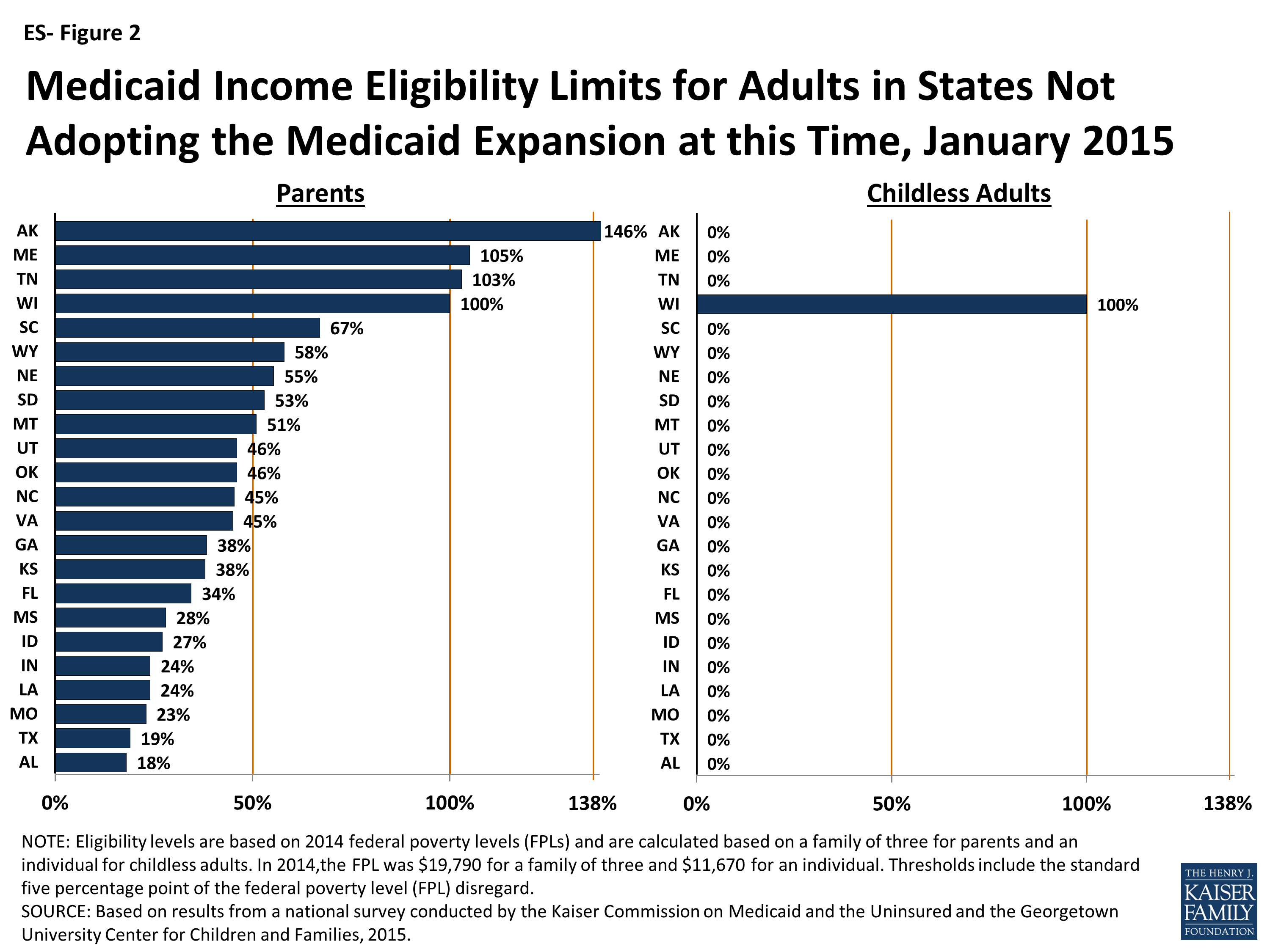

Medicaid Limits 2024 Chart Image to u, The social security wage base limit is. If you’re single and filed an individual tax return, or married and filed a joint tax return, the.

Source: nicoleawdeanna.pages.dev

Source: nicoleawdeanna.pages.dev

2024 Tax Brackets Aarp Medicare Heda Rachel, If you’re single and filed an individual tax return, or married and filed a joint tax return, the. The code §457 (b) limit for the year ($23,000 for 2024).

Source: medicare-faqs.com

Source: medicare-faqs.com

What Is Medicare Withholding, [3] there is an additional 0.9% surtax on top of the standard 1.45% medicare tax for. The social security wage base limit is.

Ct Medicaid Limits 2024 Bernie Lurleen, [3] there is an additional 0.9% surtax on top of the standard 1.45% medicare tax for. Monthly medicare premiums for 2024 the standard part b premium for 2024 is $174.70.

Like Social Security Tax, Medicare Tax Is Withheld From An.

Social security and medicare tax for 2024.

The 2024 Medicare Tax Rate Remains At 1.45% For Both Employees And Employers Totaling 2.9%, As It Was In 2023.

The rate of social security tax on taxable wages is 6.2% each for the employer and employee.