Nc Property Tax Rates By County 2025. This calculator will compute your tax bill based on the value of your property and your county/township and fire district tax rates. How to find the details of your property’s appraisal.

This includes the county, seven cities or towns and 16 fire districts. Tax rates would stay the same for property owners in the $12.7 billion.

Contact Tax Administration By Phone:

The wake county board of commissioners voted on june 3 to adopt a $2.08 billion budget for fiscal year 2025.

Tax Rates Would Stay The Same For Property Owners In The $12.7 Billion.

The north carolina general statutes require all.

Nc Property Tax Rates By County 2025 Images References :

Source: alvinabshanie.pages.dev

Source: alvinabshanie.pages.dev

Property Tax By State 2025 Dorice Robena, Values determined by the current. Because home values soared in the revaluation, homeowners will.

Source: goldton.info

Source: goldton.info

Property Tax Calculator North Carolina » Veche.info 24, This includes the county, seven cities or towns and 16 fire districts. County and municipal property tax rates and year of most recent reappraisal.

Source: myviewfromthewoods.com

Source: myviewfromthewoods.com

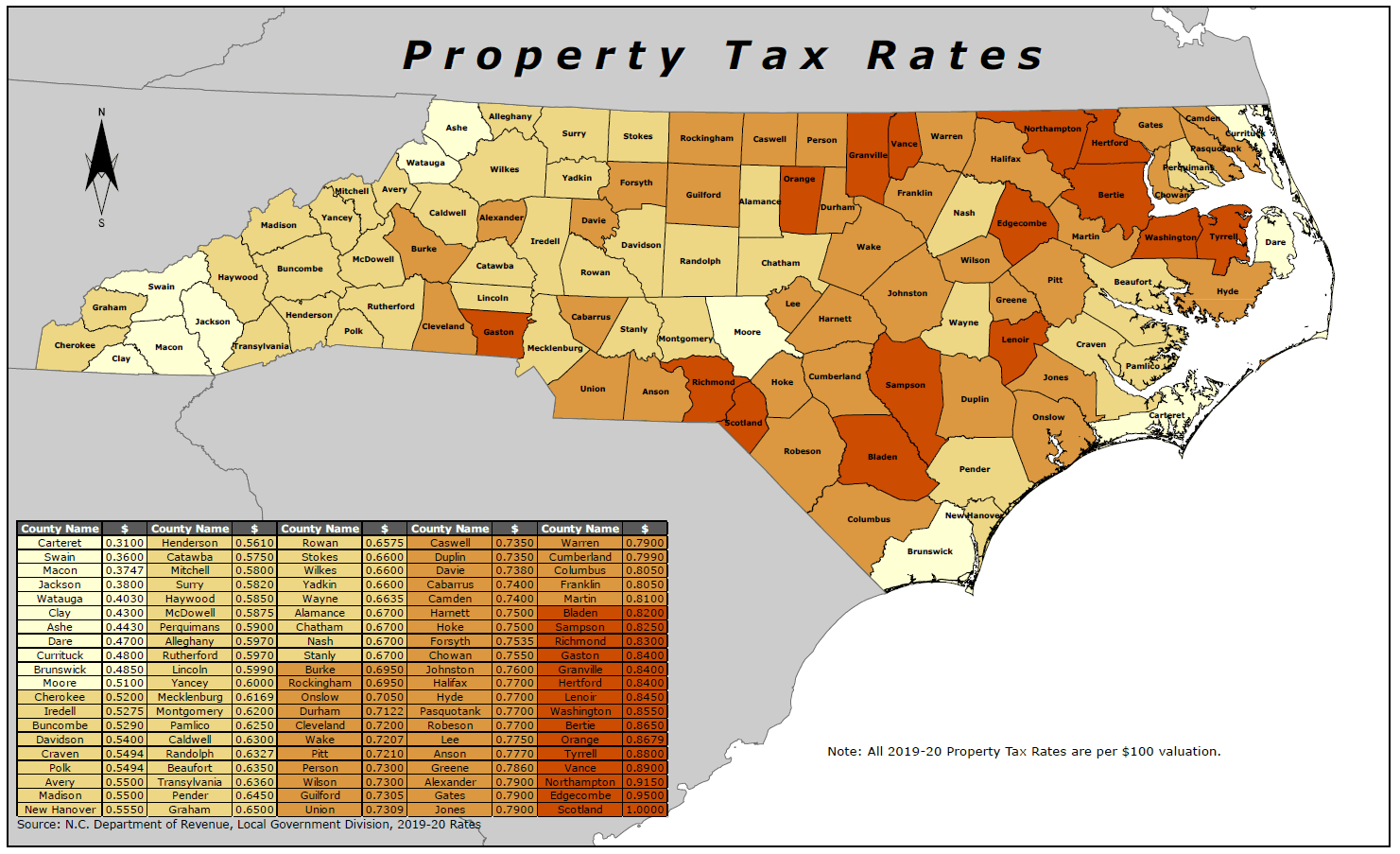

13 North Carolina Counties with the Lowest Property Rates, Property bills are going up around the triangle, and in wake county some property owners are seeing increases of hundreds or thousands of dollars. View examples of how to calculate property taxes.

Source: www.bluewaternc.com

Source: www.bluewaternc.com

Carteret County Tax ReEvaluation Bluewater NC, Carteret county tax administration is currently conducting a general reappraisal, which occurs every four years in carteret county. You can use the tax calculator in the left.

Source: www.ezhomesearch.com

Source: www.ezhomesearch.com

The Ultimate Guide to North Carolina Property Taxes, County and municipal effective tax rates. Click link below to see details.

Source: propertytaxnc.org

Source: propertytaxnc.org

NCAAO Regional Tax Associations North Carolina Property Tax, 2024 franklin county tax rates. County property tax rates for the last five years.

Source: myviewfromthewoods.com

Source: myviewfromthewoods.com

13 North Carolina Counties with the Lowest Property Rates, Because home values soared in the revaluation, homeowners will. This includes the county, seven cities or towns and 16 fire districts.

Source: eyeonhousing.org

Source: eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing, These rates are per $100. Carteret county tax administration is currently conducting a general reappraisal, which occurs every four years in carteret county.

Source: staeti.blogspot.com

Source: staeti.blogspot.com

Property Tax Zip Code STAETI, County and municipal effective tax rates. Values determined by the current.

Source: www.icharlotterealestate.com

Source: www.icharlotterealestate.com

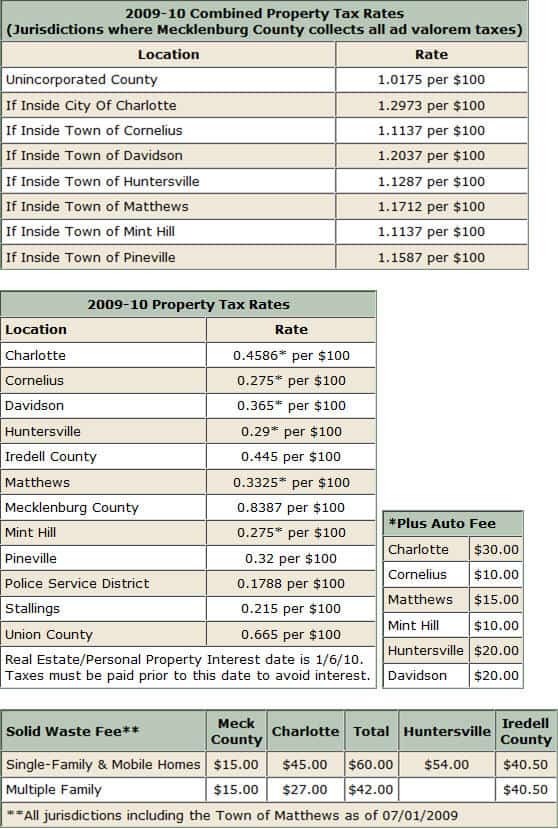

Charlotte Area Property Tax Rates Charlotte NC Homes for Sale By The, The brunswick county ad valorem (property) tax rate for fiscal year 2025 (july 1, 2024 to june 30, 2025) is 0.3420 (34.20 cents per $100 value). This page contains tax rates as approved for lincoln county and city of lincolnton for fiscal year/budget year 2024/2025.

The Steps Of The Process.

County and municipal property tax rates and year of most recent reappraisal.

The Collections Office Collects Taxes For All Tax Jurisdictions Located Within The County.

Frequently asked questions (faq) list (under development) we use a.